“Brave Tango 5-8-3, special ops on board, repeat special ops on board” the police officer said on the walkie talkie as I sat at the back of a van with metal grills over all the windows.

“What have I gotten myself into?” I said to myself as a million thoughts ran through my head, mostly all Hollywood movie scenarios, as I was driven to meet the Bank of South Pacific board of directors at their head office in Port Moresby.

I was invited to share with the directors what blockchain technology was about in a 2 hour interactive presentation session. It was a privilege to be able to share what I had learnt in the last 4 years of eating, sleeping and breathing blockchain technologies but it must have been intense for them. Lots of new words and terminologies were introduced, acronyms used and demystified, and even technical concepts explained.

I didn’t want to overwhelm the directors so only shared 1 technical concept and that was the idea of hashing. Instead of defining what it was with words, I actually showed them and encouraged them to boast their new found knowledge to their peers next time they go for drinks. How’s that for a conversation starter! “Hey Mary, did you know that hashing is when you take an input of any length and produce an output of fixed length that is also unique? And the result is known as a digital fingerprint or a message digest.”

A lot of companies also want to know what other companies are doing in the financial space and ConsenSys is in a unique position of having worked with a lot of other partners on various projects around the world.

Project i2i with UnionBank in the Philippines was a great example where the goal was to drive financial inclusion to the 35 million who live on less than $2 a day and are unbanked. ConsenSys helped UnionBank build a decentralized, cost-efficient, near real time inter-rural bank payment platform to connect rural banks to each other and to national commercial banks using Enterprise Ethereum.

The tokenization of the Philippine Peso allowed the transfer and redemption of the digital tokens that were held in an off-chain “bank account”

Project Khokha was a project initiated by SARB (the South African Reserve Bank) with a consortium of seven other commercial banks to build a proof of concept to replicate the existing interbank settlement system called SAMOS that was created on March 9, 1998 by SARB. This new system used Quorum with Istanbul Byzantine Fault Tolerance (IBFT) as its consensus mechanism and Pederson commitments to create a distributed ledger between the participating banks.

The tokenization of the South African Rand (ZAR) enabled a domestic payment system allowing participanting banks to pledge, redeem, and track balances on the blockchain without a centralized central bank system, in other words without a single point of failure.

Other projects include the likes of Ubin which is a consortium effort that explores the benefits of distributed ledger technology on implementing a real-time gross settlement solution in central banking in Singapore and Komgo which is a blockchain-based open platform that is bringing commodity trade finance into the 21st century by optimizing financing processes and accelerating industry operations with digitized transactions and a trusted source of documents to reduce fraud

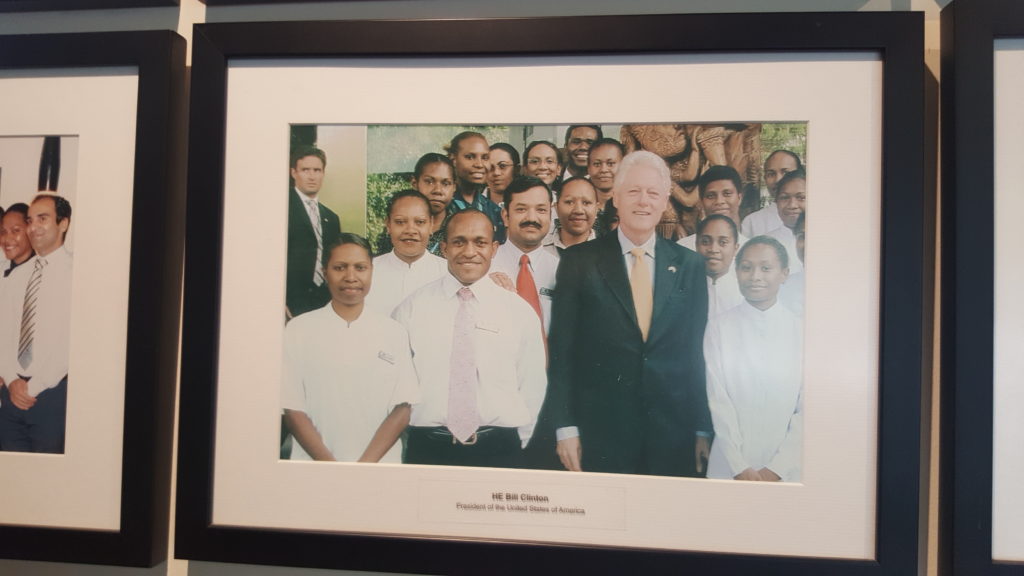

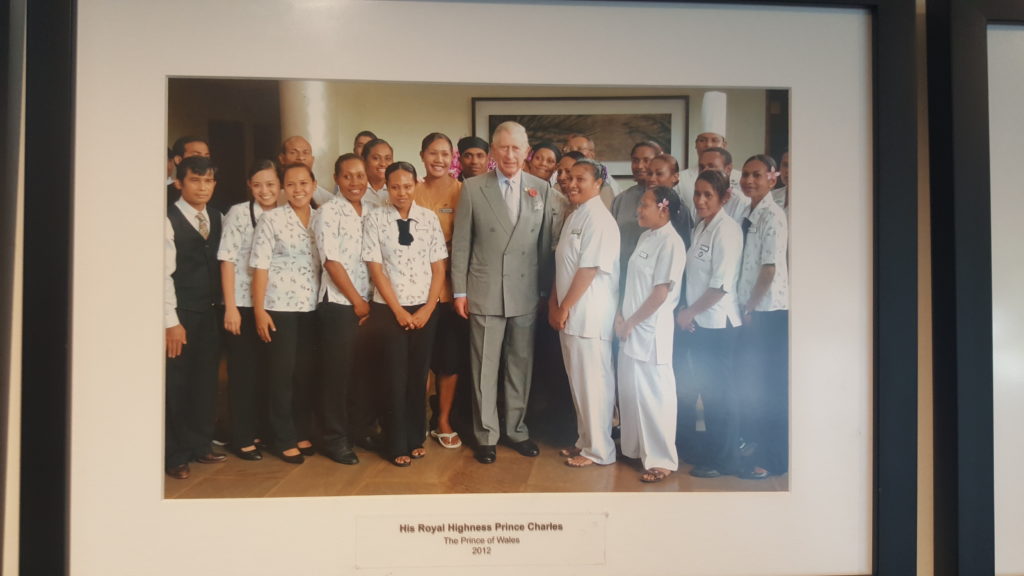

Papua New Guinea is a fascinating country and the hospitality at the Airways Hotel was impeccable. What astounded me was that plenty of dignitaries have previously stayed here including the likes of Bill Clinton, Helen Clark, Christine Lagarde, Prince Charles, Mike Pence, several Australian former prime ministers, the list just goes on.

In summary, interest still remains high from large organisations in the finance sector. The technology is still developing and while there maybe doubts from Bundesbank and Gartner’s report stating that 90% of blockchains used today will have to be replaced in a few short years, let’s let the market decide.

We all know predictions are cheap to make. If we were so good at predicting events, why didn’t these people predict Twitter, Uber, Airbnb. Further more, why don’t they put some money on the table so there’s something at stake? The people in the know keep their head down and create, while those that don’t, make headlines based on the limited knowledge they have.