There are plenty of articles, blogs and videos explaining what stablecoins are and how they work but they all define stablecoins in their own unique way and most confusing of all, categorise them differently with different terminology. Here, we’ll attempt to bring some clarity.

What is the definition of a Stablecoin?

There are lots of different ways to define stablecoins and it is often useful to appreciate these different definitions to help in your own understanding. Here are some examples:

Stablecoins are cryptocurrencies designed to minimize the volatility of the price of the stablecoin, relative to some “stable” asset or basket of assets

Wikipedia

A price stable cryptocurrency whose market price is pegged to another stable asset

Blockgeeks – https://www.youtube.com/watch?v=O3rVWLhBIPo

A dollar denominated cryptocurrency

Off Chain with Jimmy Song – https://medium.com/hackernoon/stablecoins-what-you-need-to-know-cb0bbf211864

A stablecoin is a type of cryptocurrency that is designed to maintain a stable market price.

Binance Academy

These are all valid definitions and what can be seen is that they are commonly referred to as a cryptocurrency and that they are relative, pegged, or fixed to a stable asset of some sort.

Why use stablecoins?

Currently, the most common use of stablecoins is as a safe haven for crypto traders. Funds can move easily and quickly between investment positions and create leveraged positions, without added volatility. In plain English, it is a lot easier to immediately sell Bitcoins for Tether or TrueUSD if the price drops than to convert to fiat currency into your bank account which could take a day or two.

It is also easier to move the stablecoin from one exchange to another to take advantage of arbitrage opportunities. This would be near impossible with the current banking system.

Other touted use cases include peer to peer payments, better and more stable uses in smart contracts and also as a potential reserve currency. While all this sounds promising, it is all just a means to an end because when cryptocurrencies grow in popularity and usage, they will inherently become less volatile and more stable. It is the equivalent of dropping a rock in a pond versus dropping a rock in the ocean.

Types of Stablecoins

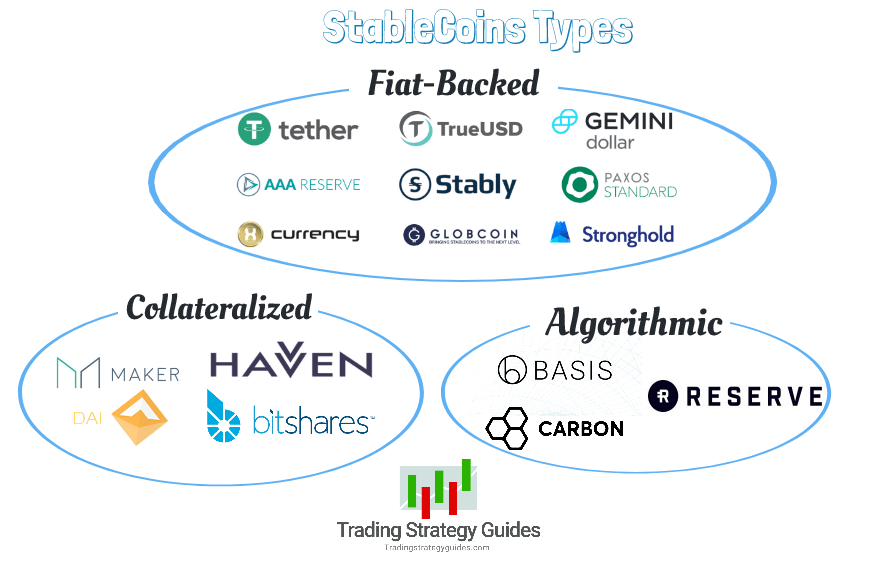

Here is where it gets confusing as everyone categorises them in a similar manner but use different terminologies. Therefore, to a new comer it can feel quite daunting. For example:

Fully backed or algorithmic

Jimmy Song – https://medium.com/hackernoon/stablecoins-what-you-need-to-know-cb0bbf211864

Fiat Collateralized, Crypto Collateralized, Non Collateralized.

Blockgeeks – https://www.youtube.com/watch?v=O3rVWLhBIPo

The diagram above from Trading Strategy Guides shows fiat backed, collateralized and algorithmic.

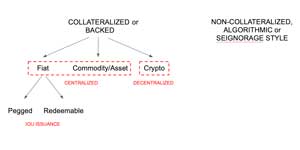

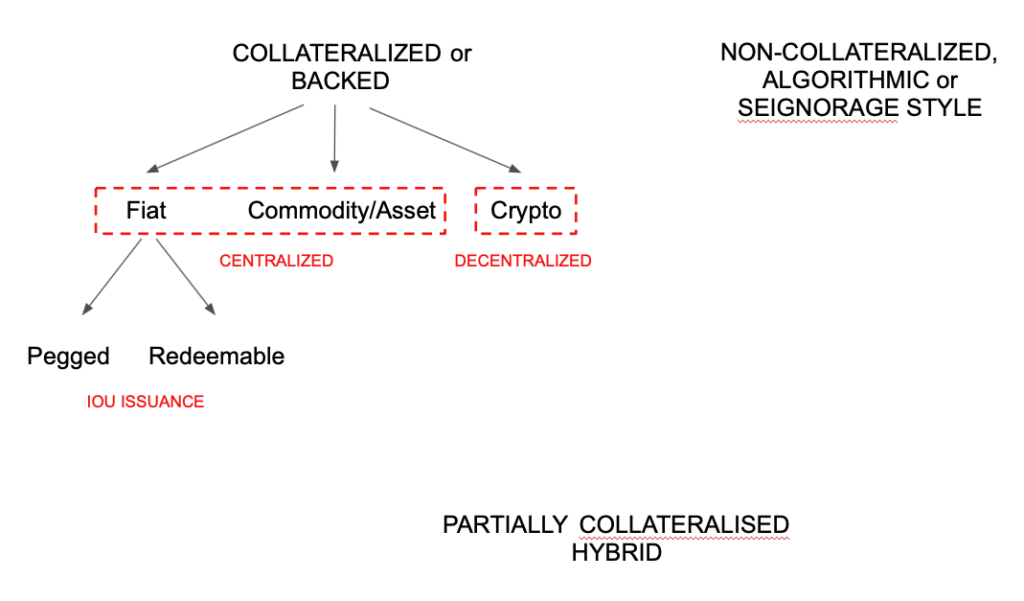

The digram below from Konfid.io shows fiat backed, crypto backed, asset backed, algo backed and hybrid.

We haven’t even mentioned seignorage yet and it is already getting confusing very quickly but if we take a step back, we can see that there are only two main types of stablecoins. Backed or collateralised and non backed or non collateralised. All the different flavours can fall into these two categories.

A popular third category some people talk about is hybrid or partially collateralised which is just a combination of the two basic categories. Also note that here, we use the term backed or collateralised interchangeably.

Backed/Collateralised

Stablecoins can be collateralised in three popular ways. With:

- Fiat – This is when you pay $1 in USD, EURO, AUD or another major currency and you get 1 stablecoin in return.

- Assets/Commodity/Metal – This is when you pay $1 and you get 1 gram of gold, silver, or platinum, some oil or diamond, or maybe a square inch of prime real estate in New York.

- Crypto – This is when you cryptocurrencies to purchase your stablecoins.

The most common question with crypto backed stablecoins is why on Earth would you use something so volatile to back a cryptocurrency that is inherently volatile but attempting to be stable? Doesn’t that defeat the purpose?

The answer is yes but the idea is to make the system decentralized so to reduce the risk, crypto backed stablecoins require “over collateralisation”. This means that you need to use $150 of Ether to purchase $100 of stablecoins as an example. Should Ether fall to say $110, a smart contract will force an automatic sale of the token.

Non backed/non collateralised

Non collateralised stablecoins are often referred to as algorithmic stablecoins or seignorage supply/style/type. Algorithmic refers to how the supply of the stablecoin is increased or decreased based on some programming code. (Some say smart contract to make it sound fancy). In essence, new tokens are minted when the supply is too low and tokens are burnt when the demand is too low.

Some use the term seignorage supply or seignorage type stablecoin which takes stablecoins to another level. Seignorage is defined as “the profit made by issuing currency, especially the difference between the face value of coins and their production costs”. So if the demand goes up pushing the price above $1, more stablecoins are created out of thin air, essentially for free, and sold at $1 so the “seignorage” is $1 x # of coins.

In the event that the price falls below $1, and there is no demand or reserve capital to bring the price back up to $1, shares are issued to potential investors. The capital is then used to “buy back” the stablecoin. Should it go back to $1, then the investors can sell and make a nice little profit, or keep the shares in exchange for a dividend.

This scenario sounds great but what if the stablecoin continues to fall? That is when things could get messy, cue “Black Swan” event here. This idea is adventurous and Basis, founded in August 2017 and announced a $133M round from top tier investors 8 months laster, is often talked about as an example. This was temporary though because as of December 13 2018, Basis shut down.

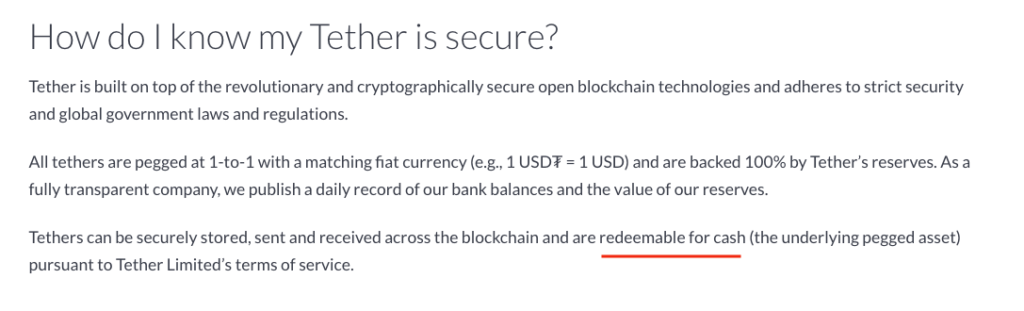

Fiat

Fiat is often differentiated into being pegged or redeemable. Tether is pegged to the USD and TrueUSD is pegged and also redeemable. While this may have been true in the past, it seems that Tether also allows its token to be redeemable for cash pursuant to their “terms of service”

How stable are Stablecoins?

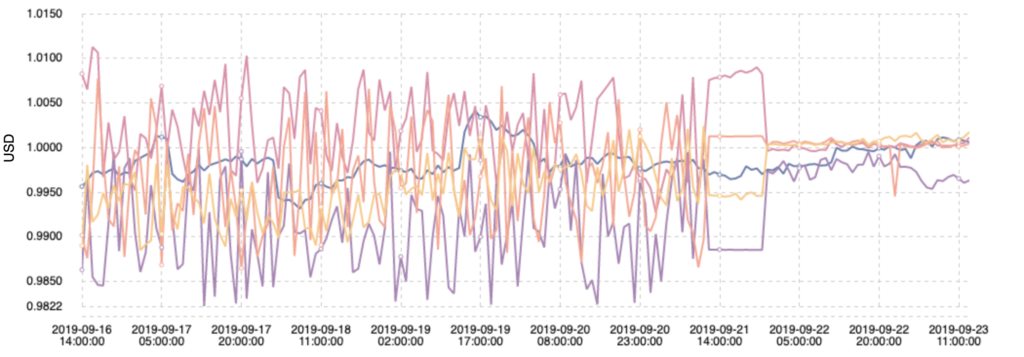

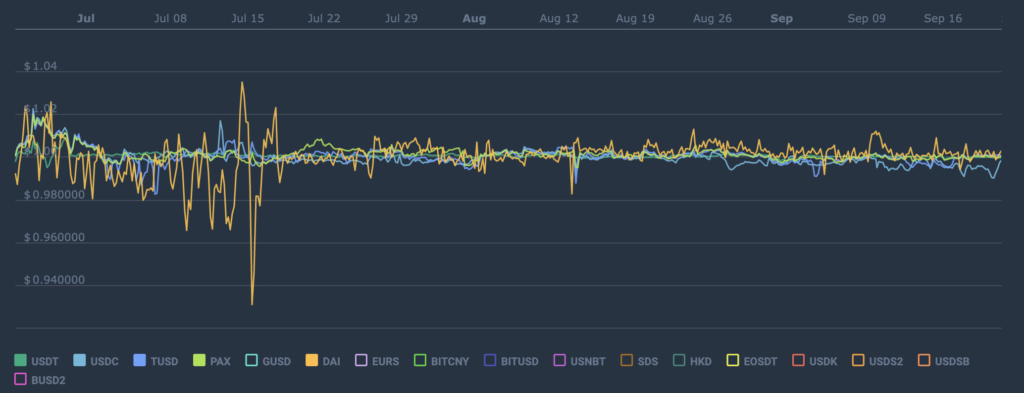

There are a few useful charts around that show the fluctuation of these stablecoins such as Coincodex, Longhash and Stablecoin Wars. See this for more information.

While it may seem like the coin wildly fluctuates, keep in mind the scale as it maybe zoomed in quite a lot.

The question remains, why can’t the price just stay at $1? The answer? Supply and demand with a pinch of arbitragers and market makers. In certain situations, such as at times of economic uncertainty, some people might be willing to pay a little more than a $1 for a particular stablecoin and there reverse is true also. This is the reason for the slight fluctuations overtime.

Specific Stablecoins

While this article does not endorse or go into depth on specific stablcoins primarily because there are many other articles that do, here is an obligatory, non-exhaustive list.

Collateralised – Fiat

AUDRamp, Candy, Gemini Dollar, EURS, Globcoin, HelloGold/GoldX, LBXPeg, Monerium, NOS, Paxos, Rockz, Saga, Stably, Stronghold, Tether, TrueUSD, USD Coin (Circle), USDVault, White Standard, X8Currency

Collateralized – Commodity

Digix Gold, GoldMint, SendGold, SwissRealCoin, Tiberius Coin, Xaurum, Vault

Collateralized – Crypto

Maker Dai, A-Euro, Augmint, Aurora, BitUSD, Boreal, Celo, CryptoPeg, Havven/Synthetix, LibreCash, Moneytoken, NuBits, Relay, Staticoin, Unum

Non-collateralized (Seignorage shares)

Basis, BitBay, CarbonUSD, Corion, Forctis, Kowala, MinexCoin, NuBits, ORCS, RYO, Steem Dollars, Terra, uFragments, Xank

Conclusion

Stablecoins are a type of cryptocurrency whose market price is pegged to another stable asset where currently the most popular use remains with traders who often use it as a safe haven and for arbitrage opportunities.

There are two main types of stablecoins, collateralised and non collateralised with other types actually either a combination or subset of the two main types.

Stablecoins are fairly stable at the $1 mark in most cases but there have been occasions where deviation has occurred. Due to the complexity of some stablecoins, in particular non-collateralised ones, stablecoins such as Basis have had to shut down.

Stablecoins are a neat concept but the theories they mimic and the techniques they employ are not entirely new and in most parts are probably just a means to an end.